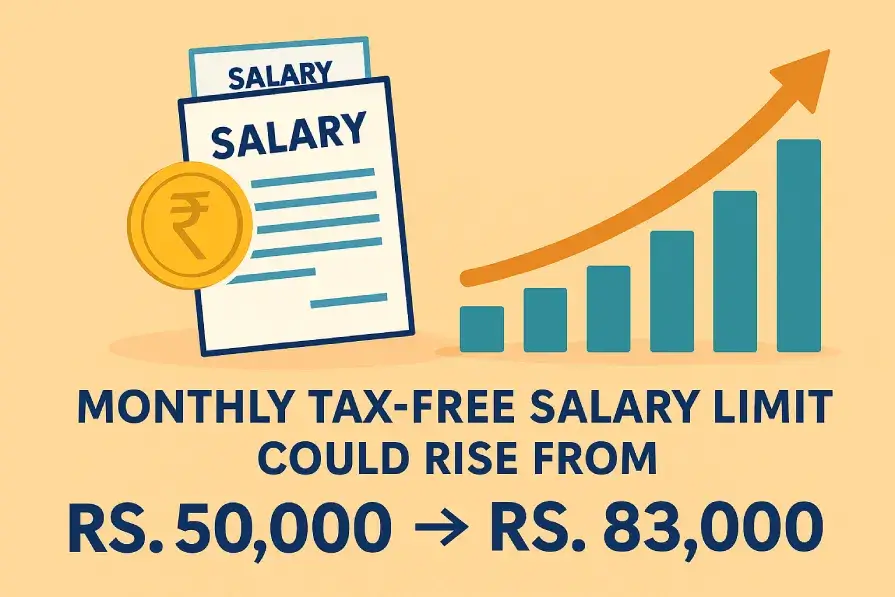

Monthly Tax-Free Salary Limit Could Rise from Rs. 50,000 to Rs. 83,000 in New Budget

Major tax reforms will be included in the 2025–26 budget to help Pakistan’s salaried class. Some sources mention that the limit for tax-free monthly earnings could be raised from Rs. 50,000 to Rs. 83,000. This decision, which has the approval of the International Monetary Fund (IMF), could significantly reduce the financial burden on millions of middle-income citizens in the country.

A Game-Changing Move for Salaried Individuals

Proposed Tax-Free Limit Increase

People in the finance industry believe that increasing the tax-free salary threshold is needed to address the impact of inflation on people’s earnings. Raising salaries to Rs. 83,000 per month would quickly help workers who are struggling with high living costs.

Learn More: DPL Makes History as the Only South Asian Company on Newsweek’s 100 Most Loved Workplaces 2025

IMF’s Approval and Strategic Flexibility

This move received support from the IMF, which shows the Pakistan government is willing to adapt to its special problems. These global authorities recognized that helping working-class people with their finances would let them increase funds for the military.

Broader Tax Relief Measures

Lower Tax Rates Across the Board

Apart from lifting the tax-free threshold, the government will reduce income tax rates for different groups. As a result, lower and middle-income groups may experience benefits that can encourage more spending and help the national economy.

Making the Tax System More Equitable

The new changes address what the public has asked for regarding fairness in taxation. The government hopes to increase its tax-to-GDP ratio by helping honest taxpayers and working towards a more equal system, encouraging more people to file taxes of their own accord.

Learn More: Earthquake Tremors Felt in Parts of Karachi: No Major Damage Reported So Far

Economic and Strategic Context

Balancing National Security with Economic Relief

Finance Minister Muhammad Aurangzeb recently made it clear that the government is entirely behind the armed forces and wants to keep the defense strong. He further said that the sacrifices made for national security should not cause hardship to people’s everyday lives. Having two main areas of focus reflects the government’s growth in managing finances for both defense and social services.

Responding to Public Sentiment

The combination of low wage growth and more taxes has long made life difficult for middle-class workers in Pakistan. The government’s move to give real support in the budget responds to people’s disappointment and proves a willingness to restore trust.

Impact on the Economy

Increased Disposable Income

Raising the amount people can earn tax-free will increase what they have left to spend, which may boost demand in the shopping, housing, and service industries. This could help the economy see faster GDP growth in FY2025–26.

Strengthening Public Confidence

Helping salaried individuals with taxes should encourage more people to have confidence in the government’s capabilities. With a renewed trust in the government, people may work together more and pay more taxes.

Expert Opinions and Industry Reactions

Economic Analysts Weigh In

Most financial analysts have hailed the approach as being “people-centric.” Economist Ayesha Khan points out that raising the tax-free threshold is needed because of inflation and will make the tax system fairer.

Private Sector Feedback

Many business leaders say that increasing what workers take home could make employees happier and more motivated at work. Retail and service businesses expect more customers if the changes are put in place.

Looking Ahead: What to Expect

Budget 2025–26 Highlights (Anticipated)

- The monthly tax-free salary cap is going up to Rs. 83,000.

- Income tax rates have been cut for each tax bracket.

- The IMF gives its support to additional defense funding.

- Tax credits that might be available to small businesses

- Preferring to help with energy subsidies and deal with inflation.

Future Tax Reforms in the Pipeline

Now that this reform has taken place, the Federal Board of Revenue (FBR) may take steps to further streamline tax filing and discourage tax evasion. Introducing a digital tax monitoring system and better services for taxpayers are the following essential plans.

Conclusion: A Step Toward Economic Relief and National Progress

There is a chance that the 2025–26 budget will be a significant change in Pakistan’s fiscal history. Raising the monthly tax-free salary limit and cutting income tax rates allows the government to be seen as a champion of both economic justice and social equity.

The IMF’s help and clear commitment to not neglecting domestic welfare make this a strategic decision that helps the people. If well carried out, the reforms may strengthen Pakistan’s economy and bring about a more prosperous and inclusive society.

Pakistanis Face 50–70% Hike in Sacrificial Animal Prices Ahead of Eidul Adha 2025 – ZOQ Pakistan

June 3, 2025[…] Monthly Tax-Free Salary Limit Could Rise from Rs…. […]