Searle’s Financials Shine While Market Undervalues Growth

Searle Pakistan (SEARL) has steadily attracted more investor attention as one of the nation’s top pharmaceutical companies. The stock price of Searle has been almost steady at Rs. 85 lately, while the company’s finances prove that it is growing, operates efficiently, and is adaptable for the future.

While the market has been slow to react, Searle’s fundamental health has improved which makes it a favorite among those who want a lasting investment in the country’s healthcare sector.

Record Revenues Signal Strong Operational Momentum

Searle Pakistan announced in its recent financial statement that its revenues rose to record heights and net income increased substantially. The main reasons for these results were:

• Domestic consumers are buying a lot.

• Growth in the ability to create products

• Managing costs in an effective way

Compared to other more volatile parts of the economy, demand for pharmaceutical products is not very flexible. Companies like Searle can maintain profitability because people keep buying what they sell, regardless of what is happening in the economy.

Learn More: MrBeast Becomes the Only Self-Made Billionaire Under 30: A New Era in YouTube Content Creation

Institutional Investors Quietly Accumulating

There is little movement in SEARL shares each day, but strong purchases by patient investors are keeping their numbers high. It seems that institutional buyers believe the market price of the company does not reflect its actual financial situation.

A financial analyst in Karachi said, “We can see the economy recovering, but this hasn’t been fully captured in stock prices yet.” Usually, this shows there are unnoticed interests hidden within the institution.

Diversified Portfolio Anchors Resilience

Searle develops products in a number of popular therapeutic fields, such as:

Cardiovascular health is the topic of focus here.

• Gastroenterology

• Handling pain and dealing with it

• Antibiotics

Such a variety in the business means Searle faces less risk and has the potential to grow with each new change in healthcare demand in Pakistan. Because Searle mainly promotes prescription products, it has maintained its market position and increased its reputation among medical experts.

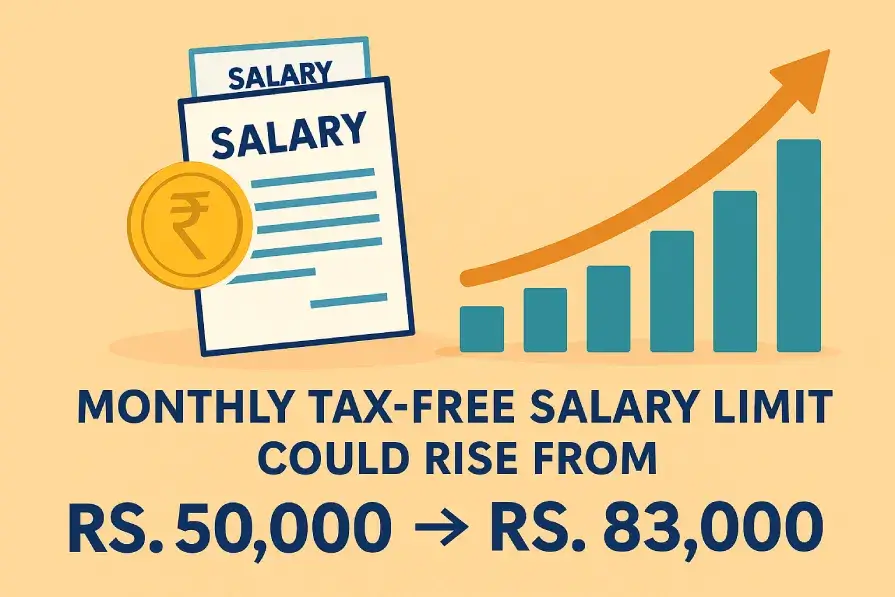

Pricing Deregulation Offers Margin Upside

Government actions to cut down on pharmaceutical regulations have created fresh opportunities for companies like Searle to increase the profit they make. As part of the policy, Searle can produce locally and cut through bureaucracy, helping the firm lower costs and improve its facilities.

Because it is WHO-approved and follows worldwide quality rules, Searle is well-placed to profit from reduced regulation for domestic and foreign sales.

Learn More: Record Gold Price in Pakistan: Rs 350,000 Per Tola

Expanding Global Footprint Through Exports

It’s not only local markets that he caters to. It is growing internationally by relying on its ISO-certified facilities to meet standards around the world. The increase in products suitable for global markets now gives the company a way to grow at home and abroad.

Because of this trend, companies are better able to deal with local instability, which supports stable gains for shareholders over time.

Strong Financial Health Amid Economic Turbulence

Pakistan’s stock markets are being influenced by greater inflation, currency deprecation and unknowns about the country’s political climate. Yet, Searle’s balance sheet is incredibly strong due to these factors:

• Being careful with spending

• Getting jobs completed on time

• Reinvestments made with a plan

Thanks to these changes, Mitsui still holds on to its profits and keeps investor trust, while most sectors suffer.

If you want more information, check the official Searle Pakistan website.

Future Re-Rating Seems Likely

Should stability and improved budgeting take place in H2 2025, experts predict a likely update in SEARL’s share valuation. If market sentiment matches reality in the economy, those who remain investor patients may see significant rewards.

The current prices make it an attractive time for value investors who think Searle will grow strongly over the long run.

A Rare Gem in Pakistan’s Healthcare Sector

Through Searle’s acting, you see a mix of talent rarely seen.

• Stability when the wider market is very active

• The company’s finances are growing strongly

• Regular improvements in quality and the conditions for education

• Putting greater importance on increasing shareholder value over the long term

Because of its consistent growth, increased population and sharper health focus, it is different from most other companies traded on the Pakistan Stock Exchange.

Conclusion: Time to Reconsider Searle’s Investment Case

Right now, the prices of Searle shares are far from what their performance shows. Even though investor sentiment is cautious, skilled investors are gradually buying company shares as they believe its share price will rise to match its real worth.

Thanks to its strong results, international opportunities and well-established roots in Pakistan, Searle society is ready for ongoing growth. Among the market leaders on the PSX, Searle is an underrated company that provides reliable returns to medium- to long-term investors in a protective sector.