Punishing the Honest: Why Pakistan’s Tax System Needs Urgent Reform

The revival of Pakistan’s economy depends on raising taxes without stifling investments or legal economic activities. But the fiscal strategy in use is moving us in the wrong direction. By keeping the burden on compliant people and companies, the government discourages others from choosing formal sectors and makes the investment climate worse.

Releasing the 2025–26 federal budget soon means it’s time for change. Instead of trying to tax the few people who file, the government should develop a system that accepts many more taxpayers and encourages them to be compliant.

A Flawed Approach: Taxing the Few

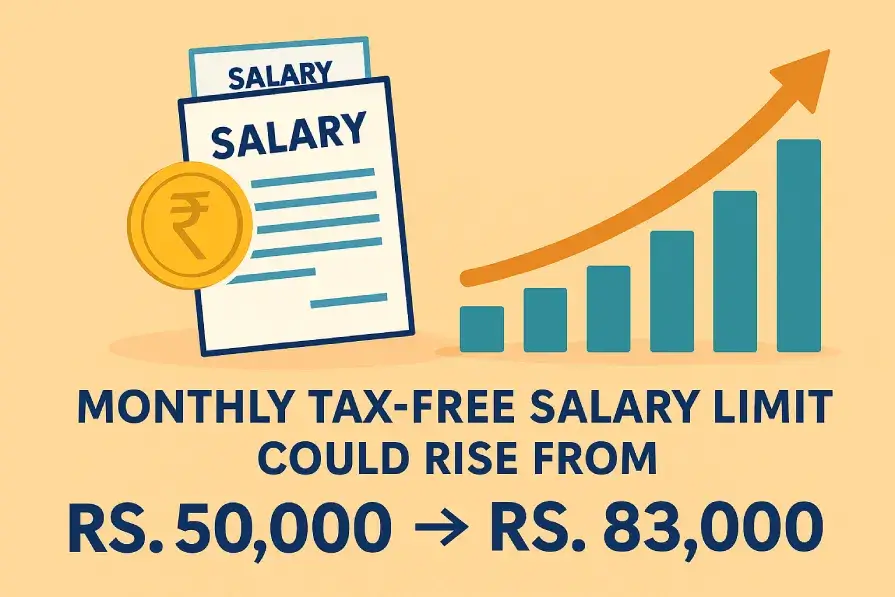

A lot of Pakistan’s tax revenue depends on a small number of registered individuals and firms who pay multiple direct and indirect taxes. As an example, anyone earning over Rs. 10 million has to pay a 10% income tax surcharge. Although meant for high earners, the new rule mostly burdens salaried professionals, who already have tax taken out of their pay when they earn it.

This makes companies think that compliance will only lead to more charges, not any incentives. Despite this, the informal sector is busy and does not pay taxes.

Learn More:

The Corporate Burden: Taxing Productivity

The pressures faced by registered companies in Pakistan are much the same. They have to pay a super tax, a turnover tax and several sector-specific duties in addition to the 28% corporate income tax. However, in comparison to big informal sectors such as wholesale, retail and farming, what these sectors earn isn’t reflected in government revenue.

To make Pakistani businesses better, we need to slowly bring down the corporate tax from 28% to 25% and phase out the super tax. They would reduce the challenges companies face in the system, opening up new paths for growth.

Undermining Investment and Savings

An often ignored effect of today’s tax strategy is that it drives people away from making long-term investments. The last few years have seen tax credits for mutual funds, life insurance and IPO contributions either taken away or deeply cut by the government.

Using this approach now is exactly the opposite of what Pakistan needs for capital growth. If these tax credits are reintroduced, households might direct their money into useful areas which could secure economic stability for years to come.

Learn More: Dr. Maheera Abdul Ghani: First Pakistani Woman to Earn PhD in Material Science from Cambridge

Indirect Taxes: Driving Up Costs, Locking Capital

The problem relates to indirect taxes that impact businesses and consumers. Tasks linked to sales tax refunds and input tax disallowances hold up working capital, mainly for export firms and important industries. As a result, sectors such as pharmaceuticals and telecom have faced difficulties following the end of zero-rating and the new customs duties on important imports.

While they bring in extra money now, they can also drive up the costs of goods and make it harder for people to buy those products. Restarting zero-rated regimes, mainly in industries offering essential goods or export items, should be considered by the government.

The Real Solution: Broaden the Tax Base

Rather than keeping up taxes on the compliance side, officials are urged to bring untaxed or unregulated fields into the formal system. Pakistan’s GDP benefits greatly from the services, real estate and retail markets, which, however, are mostly not taxed.

By tracking and checking data, businesses can find and settle compliance issues more efficiently. With a full track-and-trace program for tobacco and beverages, the chances of illegal trading and incorrect tax reporting will fall.

Simplify the Tax System for Greater Participation

The move toward greater simplicity and transparency should be a priority during tax reform. Many current laws include aged exemptions, vague deduction rules and confusing ways to comply. It is important for the government to allow deductions for healthcare, education and housing costs and eliminate any unnecessary things that stand in the way of taxpayers fulfilling their payments.

In addition, organized savings stimulate regular jobs and offer financial security to those nearing retirement.

Conclusion: A New Direction for Budget 2025–26

The government cannot rely on only punishing compliant people for long. It scares away investors, destroys confidence and leads more individuals to refrain from participating in the official economy. In 2025–26, the federal budget should introduce a tax structure that encourages fairness, supports development and collects a larger amount of tax from people who comply. Economic revival can happen only if daring changes are implemented. To create trust and a firm economy, Pakistan must reduce the workload of taxpayers, motivate new investments, streamline the tax system and widen its sources of taxes.