Pakistan May Face Rs. 2 Trillion in New Taxes Next Year

Pakistan’s federal government is going to raise its tax collection target by Rs. 2 trillion for the new financial year, aiming to collect a total of Rs. 14.3 trillion. This is a 16% increase over the revised target of Rs. 12.3 trillion currently in place and reflects the growing ongoing fiscal problems the country is encountering. The new target would be equivalent to approximately 11 percent of Pakistan’s forecasted GDP, highlighting the government’s gravity in pursuing economic stabilization.

Government’s Plan to Boost Revenue

For this conspicuous target, the government is planning to add Rs. 500bn to the new taxes already collected of Rs. 1.3bn this year. This proposed tax increase is part of larger endeavors to observe international financial engagements and balance national matters.

The plans will be assessed by the International Monetary Fund (IMF) during its course scheduled for mid-May 2025. The fine print will probably go into the federal budget, to be shown in early June.

Why the Sudden Tax Hike?

The growth of the tax target is due to many factors,

• IMF conditions assuring bailout and loan deal

• Increase in the fiscal deficit and public debt

• Rapid need to down-size of dependant on foreign donation and borrowing

• Currency devaluation and very high level of inflation cluttering government revenues

Pakistan has come under heavy pressure from international lenders especially the IMF which wants reforms and revenue measures before a new tranche of loans can be freed for it.

Business Sector Raises Concerns

With the information about the planned tax increase, business organizations, and Trade associations are in urging government to have a look at the broader economic impact. Their key demands include:

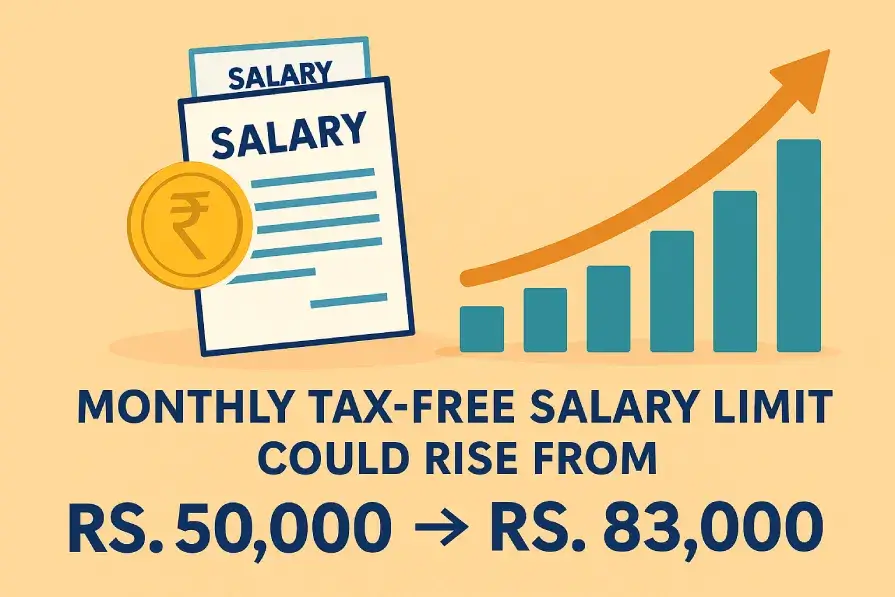

• Tax changes to ease the pressure for low-cost and medium-cost workers

• Cut corporate tax rate to stimulus business growth

• Relief for Small and Medium Enterprises( SME).

Though these measures are designed to boost economic activity and promote fairness, since these economic analysts argue that the government has only very limited abilities thanks to the financial hardiness as well as the contract which he has made to global creditors,.

IMF’s Role and Influence

The IMF’s mid-May review is to be a major provider of guidance on the tax plan. Pakistan’s talks with the IMF are conditioned on meeting certain revenue targets, and fiscal reforms being undertaken.

Any mismatch from the intended tax collection goals will impact the release of funds under the Extended Fund Facility (EFF) or new program financing under negotiations. Thus the government must walk a tight-rope between domestic demmasad and international commercatons.

Economic Challenges Remain

Pakistan’s economic condition remains fragile. The country faces:

• Shoot rising inflation now at double-digit levels.

• Low level of reserves from abroad, inadmissible trade restrictions

• A widening trade deficit

• Cost of managing increasing public debt by servicing it,

In such a case, raising domestic revenue is important. But over-taxation runs the risk of killing the growth, demoralizing the business and making unemployment even deeper.

Can Pakistan Balance Growth and Revenue?

The budget which the Centre is preparing now, is going to be a test of fiscal leadership. It must meet IMF and other parties’ demand but should also safeguard local business sector and public interest economically.

If done with good intention, the Rs. 2 trillion taxation hike can help:

• Reduce Pakistan’s budget deficit

• Lower reliance on foreign loans

Public Space that Allocated for public investment of infrastructure, Health, Education

•.LayoutControlItem macroeconomics indicator to attract foreign investment

Yet also suboptimal tax policies risk rankings, avoidance, malts, and cramped economical rebuttal.

What Citizens Can Expect

For the ordinary Pakistani, the new budget could pack more expense, greater utility costs, or fresh taxes on services, goods and consumption. Ayda en 잡담 key areas sẽ bị ảnh hưởng bằng:

• Fuel and energy prices

• Telecommunication services

• Retail sector and imports

• Luxury goods and non-essential items

This could be the final blow to increase the cost-crisis which is already being felt inflation and doubts about employment. If social protections or subsidize support is not provide, to more vulnerable section society they may suffer serious hardship.

Experts Recommend Strategic Reforms

Economists and tax specialists have recommended the government to think of expanding the tax base other than just increasing the rates. Suggestions include:

• Taxing the black economy

• Crackdowns on tax evasion and corruption

• Providing incentives for voluntary compliance

Here are some of strategies that may contribute to sustainable longterm revenue growth without imposing an inappropriate fiscal burden on current taxpayers.

The Road Ahead

Even if raising the tax needs to be done, the government must do it carefully and smartly. A good and fair tax system, supplemented by relief for vulnerable members of society, would be to address fiscal crisis in order to pave the way to sustainable growth.