Govt Collects Rs. 169 Billion in Property Tax in Nine Months of FY 2025

During the initial nine months of fiscal year 2024-25 the Federal Board of Revenue (FBR) recorded Rs. 169 billion in withholding tax (WHT) from property transactions making it a new record for government property tax collection. The recent tax collection figures exhibit a 24% surge by reaching Rs. 169 billion for the fiscal year 2024-25 first nine months when compared to Rs. 136 billion received last year.

Strong Growth Despite Drop in Transactions

The increase in property tax revenue became apparent during a period when property deals decreased by 15%. Although the number of real estate transactions declined the government successfully raised its property tax revenues. The sudden increase in property tax collections came from policy adjustments that increased taxes on property deals involving specific groups of buying and selling partners.

Revised Tax Rates Drive Collection Increase

Property tax collection has increased substantially because the government increased withholding tax rates.

Tax witholding happens at a rate of 3% for filed taxpayers but 6% for taxpayers who are not registered.

The tax rate for property buys stands at 3% for taxpayers who file but exceeds 10.5% for those who do not file.

The regulatory changes in tax rates motivated additional people to file their taxes while making it less desirable to avoid taxation. The strong financial penalties applied to non-filers allowed the FBR to obtain greater amounts of potential revenue.

Focus on Non-Filers Boosts Revenue

The government has discovered non-filers as an especially productive objective for their tax enforcement initiatives. When non-filers transact property they are held to extremely high tax rates of withholding.

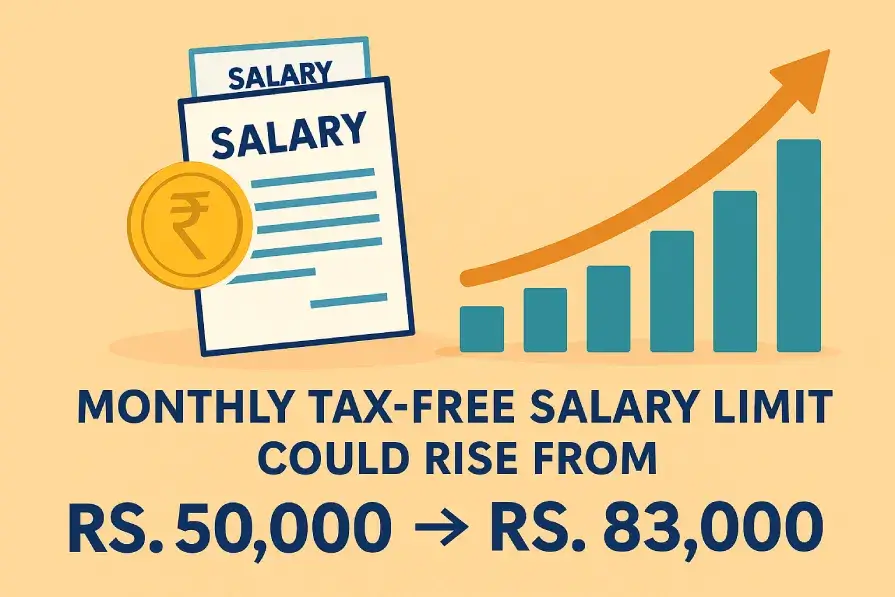

Possible Removal of FED on Property Transactions

The government plans to eliminate Federal Excise Duty (FED) on property deals soon after modifying its WHT structure.

The real estate sector stakeholders show support for this plan since it will increase market confidence and market liquidity.

Challenges Facing the Property Market

The regulatory landscape and rising costs discourage property investors from transacting because they wait on the sidelines to buy.

Proper tax documentation requirements have created delays within the informal property deals.

Property market investor sentiment remains impacted by random economic factors that include unstable currency values along with inflation rates and destabilizing political changes.

Experts maintain that the Pakistan real estate sector needs well-disciplined tax reforms to achieve sustained health.

FBR’s Broader Strategy for 2025

The FBR’s effective property tax collection methods are part of an organization-wide approach to build up the tax collection base and decrease dependency on indirect taxation.

The implementation of modernized initiatives will establish fairness in the property market and promote transparency together with increased national revenue collection amounts.

Impact on Real Estate Investment Trends

The market preference goes to commercial real estate because it provides stable returns alongside easier navigation of regulatory frameworks.

Future months will prove essential for understanding how trends will condition the future development of Pakistan’s property market.

Conclusion

Psychological preference exists for investors who choose commercial real estate because their returns exhibit stability while regulatory barriers represent minimal difficulties to overcome.

Future months will prove essential for understanding how trends will condition the future development of Pakistan’s property market.