Bank Alfalah Posts PKR 7.04 Billion Profit in Q1 2025

Bank Alfalah Limited (BAFL) achieved a strong first-quarter performance by delivering a profit after tax of PKR 7.040 billion during the period of 2025. BAFL strengthened its position against economic market shifts through a Board of Directors meeting that occurred on April 17, 2025.

Earnings Snapshot: Q1 2025 Highlights

The provided period showed an earnings per share (EPS) rate of PKR 4.46 that represented the bank’s continuing financial success. The Board paid an interim cash dividend equivalent to PKR 2.5 per share amounting to 25% which exceeded the PKR 2.00 per share (20%) distribution from the previous year.

The bank demonstrates its dedication to shareholder value through its raised dividend payment despite the macroeconomic difficulties.

Growth in Deposits and Net Interest Income

Bank Alfalah achieved remarkable business results because of substantially growing its average current deposit levels. Bank Alfalah effectively controlled its balance sheet structure to reduce the consequences of a 1,000 basis points policy rate reduction between the current year and previous year. The strategic decision by BAFL led to a 6% YoY increase in its net interest income.

The deposit base of the bank reached PKR 2.019 trillion at the end of March 2025. The improved Current Account mix offers the bank successful control of its deposit book which allows the organization to minimize funding expenses by focusing on zero-cost deposits.

Strong Non-Interest Income Performance

The non-markup/interest income of Bank Alfalah demonstrated a 13% yearly growth during that period. The bank maintained its revenue streams by developing various revenue streams despite facing competition based fee-based revenue pressure in its product markets.

This upward revenue trend demonstrates Bank Alfalah’s capacity to stand firm against interest rate reductions while increasing its earnings from alternative types of income.

Operating Expense Trends

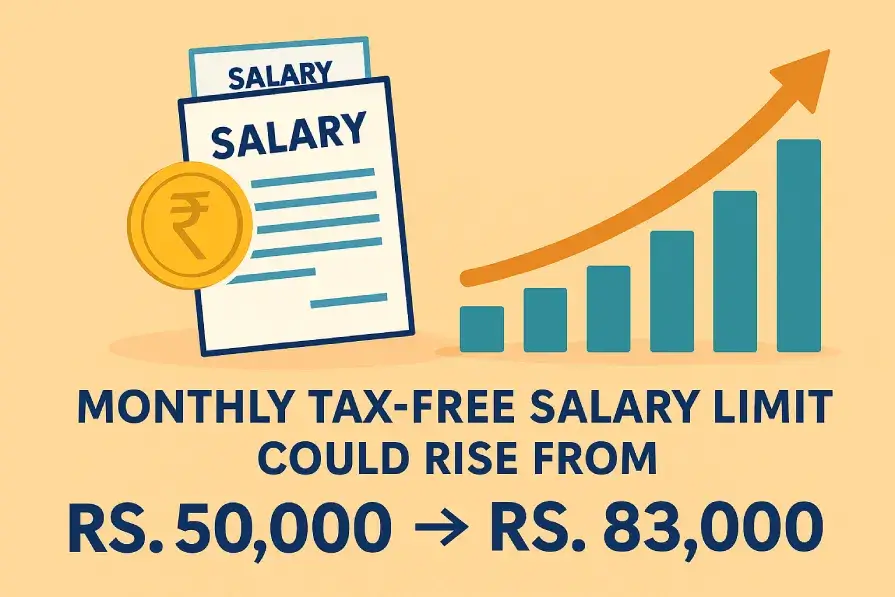

The bank experienced increased operating expenses during the first quarter of 2025 because it invested funds into network development and higher salaries and remittance service advertising. These strategic investments make up the costs but the bank views them as necessary for advancing its growth plans.

The bank illustrates its dedication to operational cost control through the stable expense-to-income ratio during its operational expansion.

Loan Portfolio and Credit Strategy

The gross advances reached PKR 0.927 trillion during March 31, 2025 which was less than the December 2024 level. Short-term loan maturity caused the decline in advances which occurred at the end of the fiscal year.

While gross advances decreased Bank Alfalah upholds a cautious credit management approach for its financial portfolio by linking its lending book to present market dynamics and risk capacity.

Capital Strength and Risk Management

The bank maintained a Capital Adequacy Ratio (CAR) measurement of 17.64% which exceeded all minimum regulatory requirements. The bank shows strong capital resilience and market shock resilience through these results.

The bank maintains stability through effective capital management which simultaneously enables its growth and funding of new lending operations.

Strategic Vision and Long-Term Goals

Bank Alfalah continues to support strategic goals by following a well-disciplined approach. The bank remains focused on:

• Long-term value creation

• Operational resilience

• Digital banking transformation

• Stakeholder trust

The bank’s ability to adapt readily provides it with both the capability to handle economic difficulties and the opportunity to seize business expansion possibilities.

Industry Outlook and Bank Alfalah’s Position

Bank Alfalah positions itself successfully in 2025 because of its strong initial performance while Pakistan’s banking sector advances through inflationary stresses and interest rate modifications. Multiple elements shape the financial sector of Pakistan and its traits consist of:

• Rising digital adoption

• Competition in retail and SME banking

• Regulatory changes impacting asset quality

The robust finances coupled with diverse revenue streams and good capital adequacy ratio establishes Bank Alfalah as a leading institution in its market.

Final Thoughts

The first quarter fiscal year 2025 financial results of Bank Alfalah emerge from a blend of strong banking principles together with forward-looking approaches and flexible operational strategies. The bank produced PKR 7.040 billion profit while enhancing its deposit statistics during Q1 2025 to maintain shareholder value delivery.

Bank Alfalah expands through capital investments while building technological capabilities and human resources to be Pakistan’s leading private-sector institution providing excellent service while pursuing sustainable growth.