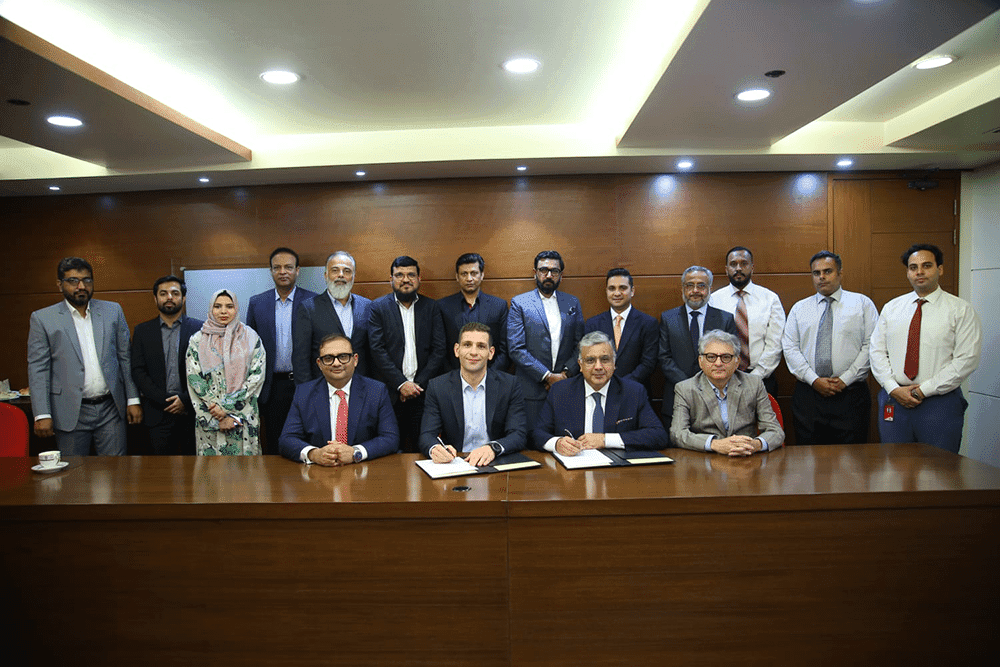

Bank Alfalah Partners with Swift to Transform Cross-Border Payments in Pakistan

Bank Alfalah has teamed up with Swift to introduce Payment Pre-validation which represents a revolutionary solution for improving Pakistan’s financial industry cross-border payments capabilities. With this fundamental partnership both standard users and business operators who conduct international money transfers can expect significant progress in service.

Pursuant to this collaboration Swift-connected financial institutions worldwide can validate beneficiary data before commanded payments to any of Pakistan’s 200+ million bank accounts. The revolutionary service gains its power from 1LINK which operates as Pakistan’s interbank switch to strengthen Bank Alfalah’s leading position regarding digital transformation in Pakistani banking operations.

What Is Payment Pre-validation?

Swift built Payment Pre-validation as an enabling tool which permits banks to verify fundamental payment details before making fund transfers across borders oney transfers through proper delivery information.

Why This Matters for Pakistan

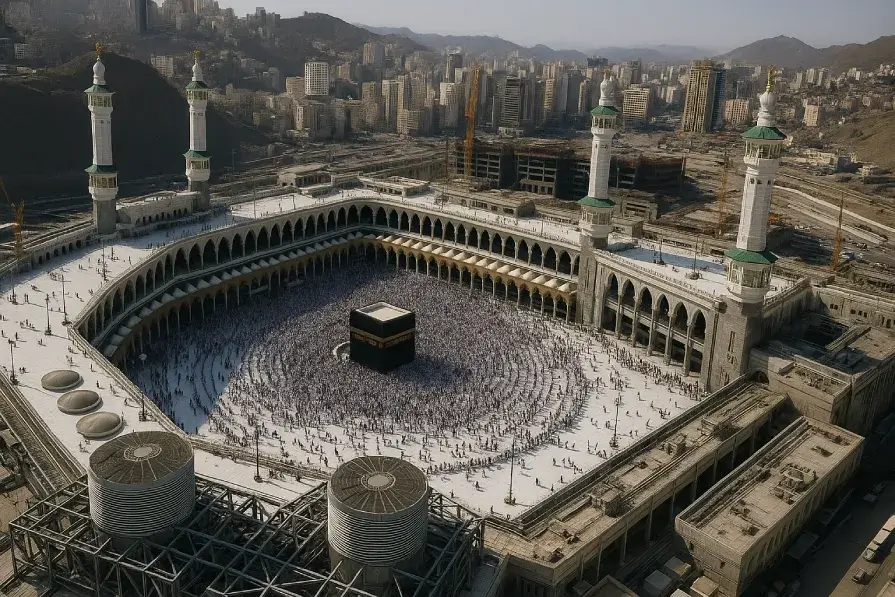

The country receives large remittances from overseas workers across the Middle East alongside European and British and American contributors. A substantial amount of remittance money faces delays and rejections together with returns because beneficiary information contains errors or is missing vital details.

Payment Pre-validation provides certainty to both senders and receivers that verified dataset checks occur prior to transferring funds. The improvement of reliability along with greater trust in Pakistan’s financial infrastructure is a direct result of Payment Pre-validation..

What the Leaders Are Saying

Group Head Corporate Banking and International Business at Bank Alfalah Farooq A. Khan made these remarks during the announcement.

Bank Alfalah dedicates itself to developing financial innovation as well as enhancing customer experiences throughout its operations. Swift has enabled us to build an essential system that reduces the costs and enhances the security of international transactions together with their efficiency. Through Payment Pre-validation services our customers experience a double benefit from products that prevent failed transactions and fight fraud and expedite payment processing.

Public comments about Payment Pre-validation were presented by Onur Ozan who serves as the Managing Director for the Middle East, North Africa, and Turkey through Swift.

Swift prioritizes offering banks top-quality payment services to their customers. The Payment Pre-validation solution from Swift gives international money senders the confidence that their funds will successfully reach their desired destination. The system establishes power for all banking institutions in Pakistan to operate.

The Cost of Failed Payments—and How This Solves It

- Studies in this field indicate that international payment failures result in annual expenses totalling about €2 billion for the worldwide financial industry. International payment failure results in transaction costs as well as time delays and customer dissatisfaction and banking reputational deterioration.

Enhanced Security and Trust

The expanding numbers of international payments create both an increase in fradulent activities together with human mistakes that occur during the processing period. The solution enables banks to detect potentially fraudulent transactions in order to send payments only to verified recipients. The increased safety level in Pakistani finance will drive consumers toward digital payment methods instead of traditional cash transactions.

Faster settlement processes together with lowered trade interruptions pair with better financial operation predictability become business advantages through this system

A Win for All Banks in Pakistan

Bank Alfalah acts as the main force behind this initiative yet banks throughout Pakistan will receive shared advantages from the program. The Swift connection makes all institutions capable of pre-validation thus enabling transactions that are secure and rapid.

Final Thoughts

Bank Alfalah and Swift have launched Payment Pre-validation through their collaboration which establishes new international banking standards in Pakistan. The integration of advanced technology with dedicated customer solutions confirms Pakistani banks can successfully lead global financial service sectors.

The partnership constitutes a new standard for cross-border payments as digital acceleration quickens across Pakistan.